Let's talk about the credit program - Lada Vesta with buyback. It provides for the purchase of VAZ cars on credit. Let's compare the Buy Back service with a regular car loan, consumer loan, and consider the pros and cons.

The official website has all the information on this loan. What does the buyback of Lada Vesta mean? After 3 years, the car dealership will buy your car at a price of up to 50% of the original cost. The advantage of the service is the low monthly payment amount (3,000 rubles). That is, when purchasing a basic Lada Vesta car, a loan is issued for 3 years. You will pay the specified amount each month.

If you take out any loan, those who issue it will always spread your butter on their piece of bread.

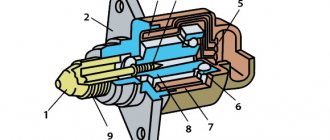

CASCO for Lada X-Ray

This is a mandatory condition, without which the potential owner of the Lada X-Ray will not see his new car. Moreover, the condition is very expensive!

CASCO is real protection for the Lada X-Ray “for all occasions.”

And the example of the most popular portal drom.ru, whose specialists tried to obtain insurance for the purchased X-Ray, and to do this only in well-known companies, is very indicative. After much ordeal, due to inconsistencies in the places of registration of the car, the owner, and the place of insurance, they managed to carry out their plans at Reso for 101,609 rubles, although some companies announced price tags in the range of 150,000 - 160,000 rubles. and higher! Of course, if you refuse an open policy, in which there are no restrictions on length of service, the number of drivers and their age, and accept certain restrictions, the price of the policy will be less, but, in any case, quite high.

The portal Drom.ru CASCO for the Lada X-Ray cost 101,609 rubles!

In addition, you need to ask the company about the deductible, which determines the amount that is not paid to the victim when the damage does not exceed the specified amount. Consenting for repairs at a specific dealership, the choice of which remains with the insurer, will also help you save.

Our realities

It can be assumed that the low popularity of buy-back is associated with the mentality of the domestic consumer. After all, the buyback program actually puts a person in constant credit dependence - by returning the car and automatically making a contribution for a new one, he again signs himself into debt bondage. And if in Europe and America the principle of “living on credit” is quite acceptable to the population, then in Russia they are not yet accustomed to this. And although a car is no longer treated as a luxury item, not everyone is ready to change it every three years.

Undoubtedly, the buy-back program is convenient for those who like to change cars frequently, because buy-back allows you to get a new car and avoid the hassle of selling your old one. Such a scheme allows you to buy a car of a slightly higher class than you could afford with a standard car loan, because up to 40% of the debt is paid off by selling the car. Buy-back is an excellent option for ambitious people or simply lovers of prestigious cars, the opportunity to drive exclusively new and most modern cars.

Advice to Sravni.ru: A person who decides to use such a program should read the contract very carefully and weigh for himself all the pros and cons of the program, drive carefully and follow all traffic rules.

Buying a Lada X-Ray on credit - calculation using a calculator

- loan terms;

- an initial fee.

As a result, the screen will display banks that are ready to provide a loan, the interest rate on it, and three more columns with amounts - the full price of the Lada XRAY, and also its cost, subject to the return of the old car through recycling or the Trade-In program. In addition, next to the bank name, the need for CASCO is displayed. Sometimes this requirement is absent, but this is a rare occurrence.

This is what the Lada loan calculator looks like for the X-Ray model.

Naturally, each case is individual, but it is necessary to analyze the most likely scenarios. The standard option is to deposit 50% of the amount (RUB 294,500 for the basic version) and installments for 36 months. In this case, interest rates will be minimal - from 7.7% (Rusfinance Bank LLC ST) to 11.8% (JSC UniCredit Bank Lada standard SZh (12.8% without CASCO)). These conditions apply subject to an initial payment of 30%.

When the payment for the Lada X-Ray is 20-25%, interest rates become higher, but the list of banks will remain the same - from 8.8% (JSC UniCredit Bank Lada Standard) to 12.7% (Rusfinance Bank Standard LLC).

If the contribution amount is only 15%, only JSC UniCredit Bank Lada Standard is ready to lend, and the rate will be 16.2% -17.2%. As you can see, it is much more reasonable to save the missing 5% of the amount and take out X-Ray on credit on more favorable terms.

UniCredit Bank is the only one that gives a loan upon depositing only 15% of the amount.

Regarding documents and requirements, different institutions have their own list, however, in general, they are repeated, and the lower the interest rate, the stricter the requirements.

Documents: Russian Federation passport required. To choose from: international passport, military ID (required for men under 27 years of age or registration certificate with deferment from service), driver’s license, pension insurance certificate, TIN certificate.

Requirements: Russian Federation citizenship; availability of permanent registration in the regions of presence of the partner bank; age from 23 to 65 years (the loan repayment period under the agreement should not occur later than the client’s 65th birthday); official place of work in the Russian Federation for at least 4 months in the last place; presence of at least two contact telephone numbers.

An example of bank requirements when applying for a loan for a Lada X-Ray.

A more clear picture of quotes for the LADA Finance loan program, taking into account different time periods and down payment sizes, can be found in the table below:

| Bank's name | Interest rate | An initial fee | Credit term | Payment (monthly) | CASCO |

| LLC "Rusfinance Bank" ST (SZh 3.9) | 7.7% | 50% (RUB 294,500) | 36 months | RUB 9,188 | Yes |

| JSC "Metkombank" AutoClassic | 9.2% | 50% (RUB 294,500) | 36 months | RUB 9,388 | Yes |

| VTB24 (PJSC) AutoStandard | 11.6% | 50% (RUB 294,500) | 36 months | RUB 9,721 | Yes |

| JSC UniCredit Bank Lada standard without CASCO | 12.8% | 50% (RUB 294,500) | 36 months | RUB 9,899 | No |

| JSC UniCredit Bank Lada standard (secure) | 16.2% | 30% (RUB 176,700) | 48 months | RUB 11,719 | Yes |

| Cetelem Bank LLC Classica | 18.5% | 30% (RUB 176,700) | 48 months | RUB 12,219 | Yes |

| VTB24 (PJSC) AutoStandard | 18.9% | 30% (RUB 176,700) | 48 months | RUB 12,306 | Yes |

| JSC UniCredit Bank Lada standard without CASCO | 20.2% | 30% (RUB 176,700) | 48 months | RUB 12,582 | No |

| Rusfinance Bank LLC ST2) | 7.5% | 70% (RUB 412,300) | 24 months | RUB 7,951 | Yes |

| JSC UniCredit Bank Lada standard | 9.8% | 70% (RUB 412,300) | 24 months | RUB 8,140 | Yes |

| Cetelem Bank LLC Classica | 11.2% | 70% (RUB 412,300) | 24 months | 8,250 rub. | Yes |

| Rusfinance Bank LLC Standard | 18.4% | 70% (RUB 412,300) | 24 months | RUB 8,859 | Yes |

Examples of buybacks

In the West, buybacks are quite common. For example, after the 1987 crisis, companies carried out share buybacks worth over a billion dollars on the US stock market.

In 2001, after the well-known tragic events, the conditions for holding buybacks were significantly softened - again, for the accelerated recovery of markets. Taxes were reduced and administrative obstacles were removed.

China followed the US example in 2007 to lift its stock market after falling. The procedure for registering buybacks was simplified, as a result, companies began to drain their excess liquidity and buy their shares at bargain prices, gradually increasing quotes. Already in 2008, the stock market of the Celestial Empire skyrocketed (yes, a tautology, I know).

And here’s another interesting article: How world exchanges work

One of the most active companies in the buyback market is Black Rock Inc. This company invests in many financial instruments and companies around the world. Since 2010, the corporation has spent more than $12.7 billion to buy up 12% of all its shares.

The French bank Societe Generale (owner of the Russian Rosbank) in 2008 bought 2.1% of its shares from minority shareholders for 1.2 billion euros. More modest than Black Rock, but still significant.

IBM is one of the companies that has been conducting buybacks for a long time. Since 1994, the corporation has already spent $10 billion on this matter, but has now suspended the program.

But Microsoft is only accelerating in terms of buying back its shares. From 2007 to 2011, the brainchild of Bill Gates spent $80 billion on buybacks, and from 2013 to 2014 – another 45. Now the company has announced an open-ended buy back program for its securities. Judging by the graph, this helps a lot.

In Russia, a little more than a dozen papers are indulging in buns and buybacks. One of the most active is Norilsk Nickel. In 2008, the metallurgical giant spent 50 billion rubles on the repurchase of its shares. There are others - MTS, Lukoil, Magnit, Obuv Rossii and many others. There will be a separate review on them.

Some companies organize buyback - repurchase - for quite selfish purposes. Here, for example, is the trick Rosneft pulled with its ears in 2009.

To begin with, it froze the payment of dividends indefinitely. Investors were not ready for this and therefore began to rapidly sell shares. Quotes collapsed from 90 to 25 rubles. Rosneft organized a buyback of its securities and bought them at a significant discount - 70% cheaper.

How does Buyback differ from a regular car loan and from Trade-in?

The Baybak program has certain similarities with a regular car loan:

- funds are issued by the bank for the purchase of a car;

- the loan agreement establishes a certain period;

- interest is charged for the use of borrowed funds;

- Payment of monthly fees is made according to the payment schedule;

- CASCO insurance is issued for the purchased vehicle.

The main difference between a standard car loan and the Buy back program is the deferment of repayment of the principal portion of the debt.

With a regular car loan, the amount of borrowed funds is distributed in equal parts over the entire loan term, but with the Baybak program, the final payment is determined, the amount of which is 20% - 50% of the cost of the car.

The difference between the cost of the car and the amount of the first and last payments is distributed for monthly payments.

The Baybak program also has similarities and differences with the Trade-in program, which is popular among car loan users. The main similarity is the offset of the value of the old car when purchasing a new vehicle.

However, there are significant differences in the following aspects:

- The borrower cannot use the Trade-in program if the car was previously purchased on credit, and Baybak provides for the possibility of selling the car during the period of using the car loan.

- The Trade-in program can be used at any car dealership that offers the highest price for a car. When using the Buy back program, the choice of car dealerships is limited by the lending institution.

- The agreement to buy a car under the Trade-in program is concluded between the seller (owner) of the car and the car dealership. Three parties take part in a vehicle purchase agreement under the Baybak program: the owner (seller) of the vehicle, the buyer (car dealership) and the bank that issued the car loan.

Thus, Buy back is a car loan that is combined as much as possible with the Trade-in program.

Baybeks in Russia

Here are a few examples of buyback from the Russian economy.

- Lukoil. The company announced a buyback in 2022 to increase shareholder value. As part of the program, the repurchase of shares in the amount of $3 billion is announced, which is about 16% of the total size of the issuer's securities.

- Magnet. The grocery retailer conducted a buyback in 2022 to stimulate management. The repurchase volume amounted to about 16.5 billion rubles, which is approximately 4% of the total number of shares.

- MTS. A large mobile operator conducted a buy back in 2022 on the open market. As a result of the program, stock quotes increased noticeably.

- Rosneft. Another oil giant announced a $2 billion buyback in 2022. (3% shares) in order to support the company's capitalization.

We recommend! Replacing PTS through State Services: step-by-step instructions

Banks providing car loans with buyback

You can get a car loan under the Buy back program at the following credit institutions:

- Absolut jar;

- "UniCredit Bank";

- Raiffeisenbank;

- Bank "Societe Generale Vostok".

The conditions for providing car loans with buyback are presented in the table:

| Car loan terms | Bank "Absolut" | "UniCredit Bank" |

| What can you buy? | New foreign cars | New foreign cars |

| Maximum amount issued, rub. | 6 000 000 | 4 500 000 |

| Maximum term, years | 3 | 3 |

| Average interest rate, annual percentage | 12,7 | 15,3 |

| An initial fee, % | From 20 | From 20 |

| Last installment, % | 20 — 50 | 25 — 45 |

Table continuation:

| Car loan terms | "Raiffeisenbank" | Bank "Societe Generale Vostok" |

| What can you buy? | New foreign cars | New foreign cars |

| Maximum amount issued, rub. | Limited by the borrower's ability to pay | 5 000 000 |

| Maximum term, years | 5 | — |

| Average interest rate, annual percentage | 11,5 | 12,1 |

| An initial fee, % | From 15 | From 25 |

| Last installment, % | 10 — 30 | 30 — 50 |

"Automotive Banking House" is the only organization issuing car loans with the possibility of repurchase for Lada Kalina cars on the following conditions:

| minimum down payment | 15% of the car price |

| maximum term | 4 years |

| interest rate | 15% per annum |

| The amount of the last payment is determined individually and can be | from 30% to 50% |

To receive a car loan under this program, the borrower must meet the following bank requirements:

- minimum age - 18 years;

- maximum age - 65 - 75 years (depending on the policy of the credit institution). The maximum age must be reached only at the time of repayment of borrowed funds;

- citizenship of the Russian Federation;

- permanent registration in the region where one of the bank’s branches is located;

- excellent credit history. Car loans with buyback are not issued to borrowers with a bad reputation;

- no outstanding loans;

- having a permanent source of income;

- income level is at least 2/3 more than the monthly contribution amount.

To apply for a car loan, you will need a standard package of documents, which includes:

- civil passport of the borrower;

- additional document to choose from: TIN, foreign passport, insurance certificate, driver’s license;

- income certificate;

- a copy of the work record book certified by an authorized representative of the employer.

Without documents confirming the availability of work and salary level, it is not possible to obtain a loan under the Buy back program.

Registration procedure

In order to take out a loan to buy a car with buyback, the user must complete a certain sequence of actions:

- Select a bank that provides buy back lending services.

- Collect a complete package of necessary documents.

- Visit the nearest branch of a financial company and write an application for a car loan.

- Wait for the bank’s verdict and enter into a loan agreement with it if the answer is positive.

- Visit a car showroom that is a dealer of a financial institution and select the car you need.

- Sign a contract with the car dealership for the obligatory purchase of the car at the end of the loan term.

- Complete all necessary documents and take the car for your use.

In order to apply for a car loan with buyback, the client will need the following package of documentation:

- passport of a citizen of the Russian Federation with a stamp of address registration;

- a certificate from the place of employment about income (template 2-NDFL or according to the Bank’s form);

- the second main identity document – international passport, driver’s license, military ID, and so on;

- CASCO car insurance policy.

The financial institution has the right to expand this list at its discretion.

Pros and cons

Buy back programs have their positive and negative sides. Among the advantages of this type of car loan are:

possibility of early repayment. If during the validity period of the loan agreement the borrower has an amount of money sufficient to fully settle with the bank, then the obligations under the car loan agreement can be fulfilled ahead of schedule. In most cases, no additional commission is charged:

Another way of early repayment is to sell the car to a car dealership at any time during the term of the loan agreement. To sell a vehicle, prior consent from the creditor bank is not required.

- the possibility of selling a car until the car loan is paid in full;

- reduced monthly payment;

- the opportunity to receive an additional amount of money if the value of the vehicle increases.

Negative aspects of the program include:

- the possibility of purchasing an exclusively new car, most often foreign-made, from a car dealer, and the seller’s list may be limited by the creditor bank;

- availability of additional operating conditions for the vehicle. The lender may limit the mileage of the car, set a condition for servicing the vehicle at an official dealer, and so on;

- mandatory CASCO registration. The insurance policy serves as an additional guarantee of the safety of the vehicle in proper condition;

The cost of insurance for the entire period of validity of the car loan agreement, by prior agreement with the creditor bank, can be included in the amount of the issued car loan. This circumstance leads to an increase in the total cost of the loan issued for the purchase of a vehicle.

The redemption value of the car is not determined at the stage of concluding a car loan agreement, which can lead to both an increase in the price of the car and a decrease in the price. The determination of cost will be influenced by many different factors: the economic situation in the state, technical condition, appearance, bank policy, and so on;

The estimated value of a car dealership is usually underestimated relative to the actual market value of the vehicle.

increasing the total cost of a car loan by accruing annual interest on a larger remaining amount. On average, the cost of a loan under the Buy back program is 10% more.

Why do companies buy back their own shares?

So, what are the main goals of the buy back program?

- Increasing interest in securities from investors, growth in quotes, which is stimulated through multiple transactions.

- Restructuring of the authorized capital by reducing the number of shares. Why is this being done?

Example 1. The company issued 1000 shares with a par value of 750 rubles. ($10 or 290 UAH) for each. Thus, the size of the authorized capital was 750,000 rubles. ($10,000 or 290,000 UAH), which was distributed in proportion:

- 40% – investor No. 1;

- 20% – investor No. 2;

- 40% are small shareholders (minorities).

So, in the interests of large shareholders (majority shareholders), a decision was made to reduce the number of shares and distribute them between investors No. 1 and No. 2 in order to increase earnings per share.

The issuer announces a buy back. Such a decision will have the following consequences:

- shares from small shareholders with a total par value of RUB 300,000. ($4,000 or UAH 116,000) goes to the issuer’s balance sheet;

- Next, the Treasury securities are redeemed. At the same time, the size of the authorized capital remains unchanged - 750,000 rubles. ($10,000 or UAH 290,000), and the number of shares is reduced to 600 with a par value of RUB 1,250. ($16.67 or 483 UAH);

- Thus, the investors' shares will be:

– investor No. 1 – 500,025 rubles. ($6,667 or 193,343 UAH) (66.67% of the authorized capital); – investor No. 2 – 249,975 rubles. ($3,333 or 96,657 UAH) (33.33% of the authorized capital).

- Receiving tax benefits. In many countries, dividends are taxed at a higher rate than capital gains.

- Another reason for buying back is to reduce takeover risk. When the price of a company's securities is at a low level, there is a chance that a large investor (competitor) will take a controlling stake.

- In case of excess liquidity, buyback of shares is a good solution for redistributing funds until the moment when the company has a new direction for investment.

- The main reason why buy back shares is carried out is to improve the relationship between the market price and profit per security.

What is Buyback and how does it differ from a regular loan and from Trade-in

Buyback is partly similar to the fairly popular trade-in scheme, which has long been offered by many car dealers. With a trade-in, the car dealership buys the car from the car owner and applies its value towards the purchase of a new one. But if the client’s car was purchased on credit, then until the loan is paid off, the client does not have the right to sell it, and therefore he cannot use the trade-in either. And if a car loan is taken out for 5 years, then you will have to drive the same car for all 5 years, at least until the loan is fully repaid.

However, if you purchase a car not under the bank’s regular loan program, but under the “Buyback” loan program, then according to it it is initially planned that the car will be sold at the end of the loan period to a car dealership agreed with the bank (similar to a trade-in). However, unlike a trade-in, there will already be three participants: in addition to the car dealership and the client, there will also be a bank.

During buyback, the Bank also issues a car loan. But a significant part of it (30-60%) will have to be repaid not as part of payments every month, but at the end of the term in a lump sum payment. This means that the monthly payment will be lower than with a standard loan program. But since at the end of the loan period a fairly significant part of the loan remains unpaid, the client has a choice:

- pay it off yourself and keep the car;

- sell the car to a car dealership agreed with the bank, and the balance of the loan will be repaid from this money. At the same time, after repaying the loan (with money from the sold car), the bank will count the remaining amount as part of the down payment when purchasing a new car.

However, if the value of the car has dropped significantly at the time of the planned sale, or if for some reason the client will not sell it, but at the same time cannot pay the rather large loan balance at once, a third option arises. Under a separate agreement, the bank may allow payments of the remaining loan amount to be extended to a new term - like a regular loan (i.e., extend the loan agreement, but without repurchasing the car).

Thus, in part, “buyback is similar to leasing, in which equipment is essentially leased, and at the end of the term, it is either returned or purchased. But to a greater extent, it is still a car loan combined with a trade-in (under a special credit program with a deferred repayment of part of the debt). Moreover, it has its own characteristics, as well as pros and cons, in comparison with a regular car loan.

Reasons for the procedure

In European countries and the USA, buyback is often carried out in order to save on taxes, because... Buybacks are more profitable than paying dividends. Therefore, the procedure is strictly regulated by law. There are the following restrictions on the volume of repurchase of own securities:

- in the USA - no more than 25%;

- in Europe – no more than 10%.

In Russia, the basis for a buyback program may be the following factors:

- reduction of the authorized capital of a joint-stock company. This procedure must be specified in the charter. The Civil Code of the Russian Federation (clause 4 of Article 99 as amended by Law No. 99-FZ dated 05.05.2014) regulates the relationship between the size of the net assets of a joint-stock company and the size of its authorized capital. If for two years in a row the value of net assets is less than the amount of the authorized capital, the company is obliged to equalize this ratio: either increase the NAV or reduce the authorized capital. This can be done in two ways: by reducing the par value of shares or reducing their number;

- reorganization of the company in the form of merger, acquisition, accession, etc.;

- requirement of a majority shareholder (holder of more than 95% of shares);

- decision of the board of directors (percentage of votes up to 10%);

- decision of the general meeting of shareholders (percentage of votes up to 25%).

A buy back can be carried out on the open market or through options, where each shareholder is sent an offer indicating the timing of the procedure and the price of the securities. Shareholders have the right to accept or reject this offer.

Car loan with buy back. Is it worth it?

According to PricewaterhouseCoopers analysts, the period of car ownership in the Russian Federation is significantly shorter than in other countries. If in Canada it is 7 years, in Japan – 6.5, and in the USA – 5, then in Russia cars were changed on average every 3 years in 2008, and by 2013 this period increased to 4 years. Moreover, people own Russian brands longer than foreign cars. This is partly due to the end of the manufacturer’s warranty, but also largely due to status changes and fashion trends. If in Germany people can buy cars of the same class for years, then in the Russian Federation a small car is often replaced with a C-class over time, then a crossover is purchased, and then an SUV. Premium car brands (Audi, Infinity, BMW, Mercedes, etc.) change even more often - once every 2-3 years. In addition, the speed at which new technologies are emerging is now much faster, and environmental requirements are constantly growing.

In this regard, banks are introducing new loan programs for the purchase of cars. Car loans with buyback, common in Western countries, have begun to appear in the Russian Federation. With their help, you can replace your old car with a new one even before the loan for the old car is paid off in full.

What happens to repurchased securities?

So, in simple words, buyback is the acquisition of your shares as property. Consequently, as mentioned above, after the repurchase, the issuer is obliged to put the shares on the balance sheet (accept for accounting at par value). If a company buys securities in its own name, then they must be sold or redeemed within a year. If the repurchase is carried out in favor of a subsidiary, you can keep the assets on the balance sheet for an unlimited time.

There are then four options:

- redemption of securities in order to increase earnings per share and stimulate market price growth;

- sale to investor;

- management motivation (distribution of shares among company employees);

- distribution among large investors (as described in the example above).

As a rule, buyback has a positive impact on market quotes: demand increases while supply remains constant, and accordingly, the price goes up.

If shares are redeemed, their number is reduced, which means the amount of profit and dividends per security increases.

Car buyback

The meaning of this car loan program is that the borrower can pay not the full cost of the car, but only a certain part, after which he is given the right to purchase a new car on credit, and he can return the used one as a down payment.

The borrower also has the opportunity to sell the vehicle borrowed and use the proceeds to repay the debt to the bank. Moreover, if at the time of redemption the client does not have a sufficient amount to repay the debt, then he can borrow these missing funds from the bank in installments. However, with the condition that the repayment period of the entire loan does not exceed 5 years.

This flexible policy of banks allows even not the richest citizens to take out car loans: monthly payments compared to payments for standard types of car loans in this case are significantly lower. No less attractive is the opportunity, after a certain amount has been paid, to choose a more expensive and high-quality vehicle.

How does it work

36.8% of the cost of the car is taken (or at your choice), the amount is frozen, and the loan is paid from the rest. After 3 years, you must return the indicated interest to the bank, or return the Lada Vesta to the car dealership, which will pay you 36.8% of the cost of the car. With the money you receive, you pay the bank for the loan and go home on foot.

There is another option - add more money to the car dealership and buy a new car. You make your own decision on what to do. If you have money, pay off the debt and leave in your car.

Comparison of borrower costs with a regular car loan and Buyback

The monthly loan payment usually consists of two parts: interest to the bank (calculated from the loan amount) and repayment of the loan body. With a regular car loan, the loan body is repaid a little each time as part of the monthly payment. And gradually the interest part in the payment becomes less and less, and the amount spent on repaying the loan body becomes more and more.

But with a buyback, a significant amount of the loan “hangs” outstanding until the end of the term. That is, a rather large amount has been “removed” from the monthly payment, which would have been used to repay the loan body. Due to this, the monthly payment (with the same term and rate) is significantly less. But interest is also paid on the outstanding amount until the very end of the loan term, and since... The loan amount decreases slightly, and the interest decreases to a small extent. And it turns out that the bank’s interest (overpayment) on such a loan will be higher than on a standard car loan.

This is clearly seen from the comparison below: An annual loan was issued, in both cases 500,000 rubles, for 1 year at the same interest rate of 15.5% (300 rubles down payment, price of the car - 800 rubles). With a buyback, the monthly payment will be almost 2.5 times lower (17.3 tr against 45.2 tr), but with a buyback for the year the interest will be paid 1.5 times more - 67.9 tr . against 43.1 tr. At the same time, by the end of the year, with a buyback, a loan of 360 tr will remain outstanding. (in a standard loan - everything is repaid “to zero”). Let’s assume that in 1 year a car purchased for 800 rubles will depreciate by 25% and it can be sold at the same price of 640 rubles. (in both cases). That is, after buyback you can get it for the car

Let's add up the car costs for 1 year in both cases:

- Baibek: invested 508 tr. (300 TR initial payment + 208 TR payments to the bank), and 280 TR received from the sale. Negative difference - 228 tr.

- Standard loan: 843 tr invested. (300 tr. + 543 tr.), and 640 tr. were received from the sale. The negative difference turned out to be smaller - 203 thousand rubles.

Thus, in this example, buyback was 10% more expensive than a standard loan (for the same period, amount and rate). And if the car dealership also values the car at a redemption price below the regular price, and if there are any additional costs, this difference will increase even more.

Ways to buy back your own shares

So, a buyback of shares is the repurchase by the issuer of its own shares in any of the following ways.

Buyback of shares on the open market (open-market purchase)

This method is the most common. The procedure goes like this:

- On its official website, the issuer announces its decision to repurchase its shares. However, the duration of the procedure can be quite long – from several months to several years.

- Next, the issuer, who in this case is an investor, submits an application to the exchange indicating the price and quantity of securities to be purchased. The timing of the application, as well as its contents, is unknown to other investors in advance.

- The purchase of shares is carried out on all trading platforms where the issuer is represented.

If an ordinary investor bought shares during the buy-back period, as a rule, in the future he will be able to sell these securities at a higher price, because there is an increase in demand.

Tender repurchase of shares at a fixed price (self-tender order)

With this method, the repurchase occurs at a fixed price above the market price and in a shorter period of time - up to several weeks.

We recommend! External and internal advertising of a car dealership

To participate in the tender, any shareholder must submit an application. If the number of securities in applications exceeds the supply, the issuer has the right to buy back more shares than were stated in the decision.

The difference between the repurchase price and the market value of the shares is the premium for the shareholder. If the procedure period has expired and the required number of securities has not been purchased, the issuer is obliged to purchase the missing number of shares at the price specified in the offer. There is a risk of a sharp downward change in the market price, as a result of which the company may incur losses.

Tender buyout based on the Dutch auction type (Dutch-auction)

With this type, there is a price range from the minimum value to the maximum. This method was used in Holland when holding auctions for the sale of flowers. In this case, the price range is set by the shareholders themselves.

After the deadline for accepting applications, the minimum price is determined. At this price, all shares are purchased according to applications that do not exceed the minimum established by the auction.

After completing the procedure, the issuer must accept the securities for balance. Such shares are called treasury shares.

Buyback features, pros and cons

Peculiarities:

- Usually, foreign-made cars are purchased under the buyback program and only from official dealers;

- loan term – usually up to 3 years,

- As a rule, the shorter the loan term, the lower the rate;

- the interest rate for repeat bank clients may be significantly lower;

- down payment – from 20%;

- The bank may allow you to include the cost of comprehensive insurance (in whole or in part) in the loan amount.

- Pros:

- The buyback loan can also be repaid ahead of schedule (i.e., sell the car to an agreed dealership before the end of the loan term, or at your own expense):

- monthly payment is significantly lower than for a regular car loan;

- if the loan was taken in rubles, then with a strong rise in the dollar exchange rate, prices for new cars will most likely increase, which means the price of a used car in rubles may also increase by the time it is sold.

Minuses:

- the cost of buying the car at the end of the term is unknown in advance - its value will be affected by the car dealership’s assessment (damage, external and technical condition, etc.);

- a car dealership can significantly underestimate a car’s valuation (relative to the market price), find fault with little things, and a bank can work with one specific car dealership, i.e. the client will not have the opportunity to sell the car to the dealership where the purchase price will be more profitable;

- the bank may impose a condition to service the car during the loan term at certain service stations (where prices may be on average higher than the market average);

- there may be some additional commissions from the car dealership or bank;

- Although the monthly payment for a loan with a buyback is lower, the total overpayment for the entire loan term may be higher than with a regular car loan.

conclusions

To summarize, the buyback program offers clients some additional opportunities that are not available with the standard form of lending (sell a credit car and buy a new one, pay significantly less monthly). But ultimately, any additional opportunities either cost more, or expenses from the current time are simply transferred to the future (the purchase of a car may be assessed unprofitably, and the total amount of interest paid to the bank will be higher, etc.).

In other words, if you sum up all the expenses, the final cost of the car under the buyback program will most likely be higher than under the standard lending program. But if we consider the cost of this excess as a payment for convenience (or for the opportunity to transfer current expenses into the future), then in some cases such a lending program may be useful. However, with buyback it is more difficult to plan your expenses in the future, because... It is extremely difficult to predict the price of a car in 2-3 years (both used and new).

Source: mobile-testing.ru

What is Buy-back

To begin with, in detail, with important details, we should consider what essentially the “Car Buyback” or “Buy-back” car loan program is. Different domestic banks use their own names for this program, which differ from each other. In particular, the terms “deferred repayment”, “residual value guarantee”, “deferred payment”, as well as “residual payment” and “Balloon” are used.

At its core, this program is a variation of the loan familiar to many of us, which is issued, most often, for a period of one to three years. However, in this case we are talking about the fact that the client, having decided to buy a new car, hands over the old one as collateral and acquires a new car with the help of a bank loan.

Loan amounts are identical to those provided for in standard lending programs. The purchase of a car is most often carried out on the basis of one of the car dealers that has an agreement with this bank. The size of the initial contribution often fluctuates in the range of 15-50% of the price of the car, depending on which bank the client is dealing with and what his financial capabilities are.

In the format of such a program, their clients:

- Make monthly payments for the car until the entire cost of the car is paid off.

- In the last month, the client must pay off the remaining balance of the debt. It is called deferred payment, the size of which, most often, is 20-55% of the cost of the technical equipment.

If the amount from the sale of a car exceeds the amount of debt (which often happens), the client has the right to use the resulting balance at his own discretion. In this case, the client chooses the type of repayment of the remaining payment. He can, in particular, pay off the balance with his own money or by selling the car through a car dealership, or, finally, pay off his debt by refinancing the remaining loan amount. If the client does not want to part with his favorite car, he has the right to keep the car after repaying the debt.

Credit conditions and example of payment calculation:

After completing the program, the car owner can:

- make the final payment and keep the car;

- hand over the car to the dealer at a price of up to 50% of its original cost and buy a new one;

- prolong the remaining payment (increase the payment period).

“LADA makes maximum use of market instruments that are attractive to our clients,” notes Vitaly Osipov, acting. Executive Vice President for Sales and Marketing of PJSC AVTOVAZ. — According to statistics, the average period of ownership of a car purchased new on the Russian market is about 4 years. Therefore, for the new generation LADA we are introducing the Buy Back scheme for the first time. Together with a favorable credit offer, this system is most convenient for those customers who prefer to frequently update their car and purchase new products on the car market.”

Apply for Buy Back today!

LADA News

We draw your attention to the fact that all information presented on the site is for informational purposes only and under no circumstances constitutes a public offer as defined by the provisions of Article 437 (2) of the Civil Code of the Russian Federation. By providing your personal data and using this website, you consent to the processing of your personal data and accept the terms of their processing

Privacy Policy

By providing your personal data and using this website, you consent to the processing of your personal data and accept the terms of their processing. Privacy Policy

To improve the convenience of using the site and ensure its correct operation, AutoHERMES uses cookies. These files contain data about your previous visits to the site. Cookies do not identify your personal data. All information is strictly confidential. If necessary, you can disable cookies using your browser settings.

voice

Article rating

Advantageous loans

If you search on the Internet where you can get a car loan, you get the following:

- The most profitable loan will be from Sarovbusinessbank - without CASCO or life insurance. Only 11% per annum, a small overpayment (about 50 thousand). The car is pledged to the bank.

- Consumer loan from Gazprombank, for 3 years at 15% per annum, overpayment is a little more (about 70 thousand). Also without life insurance and CASCO. The car is not pledged. You can take it for 5 years at 16%, then the monthly payment will be less, but the overpayment will increase.

- If you cannot confirm your income with certificates and other documents, then you will not be given a consumer loan. Therefore, go to a car dealership with your passport and get any loan. You can get a car loan from VTB 24 Bank for 3 years at a rate of 11.5% (the rate is constantly changing, so check in advance). You will have to take out CASCO and life insurance.

A car loan can be obtained not only from VTB 24 in AvtoVAZ showrooms, but also from many other banks with more favorable rates.

Advice

: Read the contract carefully - in addition to insurance, additional services may be added. For example, receiving SMS alerts, for which the fee can be a couple of thousand rubles.

The above calculations are approximate; each bank has individual conditions that change frequently. Choose carefully and read the contracts so that unnecessary payments are not added. Write comments about how you applied for car loans for the Lada Vesta, and how much you overpaid.

Conditions

All conditions for the format in which the sale of a car through a car dealer will be pre-registered in two ways through:

- Purchase and sale agreement.

- Repurchase agreement.

In particular, sometimes they practice the issue of technical service (car maintenance) exclusively at the service base of an official dealer. When a car is sold through a dealer, it is based on a purchase and sale agreement: in this case, the dealership acts as the buyer, and the client acts as the seller. When the agreement is signed, money is transferred in the amount of the remaining balance on the loan.

The loan is closed when the money has arrived in the borrower’s account. The transfer of the purchased technical equipment to its new owner takes place through an agreement. The minimum down payment is most often 10% of the borrower's personal funds from the price of the car, and the remaining payment is often determined in the range of 20 to 55%.

Examples of buy-backs

Now let's give a few examples from foreign practice.

- BH Billiton. A major mining company announced its decision to conduct a buyback in 2010 in order to get rid of excess liquidity reserves. For the period from 2010 to 2022. the corporation bought back about 8.3% of the share capital.

- IBM has been conducting buybacks since 1994. The amount of ransoms amounted to more than $10 billion.

- Apple has been doing share buybacks since 2013. When the company announced the start of a buyback, the securities rose by 8% in one day. For the period from 2013 to 2022. The company's market capitalization increased by approximately $200 billion.

- Microsoft Corporation began conducting buybacks in 2007. For the period from 2007 to 2013. approximately $125 billion worth of shares were repurchased. In 2014, an open-ended buy-back program for the company’s securities was announced.

Case four

Salon fraud when placing a car on commission.

At the moment, the service of placing a car on commission is often found in showrooms. In this case, the vehicle will be located on the territory of the car dealership. At the same time, car owners rarely go into the intricacies of such a process, and practically do not read the contract itself, but sign it, unconditionally trusting the intermediary. Imagine their surprise when they have to deal with such “misunderstandings”:

1. One fine day it is discovered that the car is damaged (broken, smashed) and can no longer be sold on the same terms. The dealership refuses to return damage caused to the car during storage, because “a stone could have been thrown at the car by hooligans passing by” or “the scratches appeared when the car was rolled onto the site.” It is surprising that even when a vehicle is stolen, the car dealership tries to absolve itself of all responsibility for the incident.

2. If you manage to find a buyer for your vehicle on your own, the car dealership may require a commission for its “maintenance” on its site. The amount will be approximately 150-200 rubles per day.

3. If representatives of a car dealership see your advertisement, which you did not have time to remove before submitting it to the commission, they may impose a fine on you, and this will already cost 3,000-5,000 rubles out of your pocket.

You can avoid such an unpleasant situation if you carefully read the contract before signing. Agreements in words do not play a role, therefore everything that you agreed on should be reflected in the documents. This will help you in a conflict situation. Adjustments to the contract by intermediaries are not welcome, so you will not be able to change it if you have certain doubts - the salon employees primarily care about the interests of their employer.

There have been cases when clients came to the parking lot to pick up their cars, but were unable to find not only their property, but also the parking lot itself. Of course, in big cities such a situation is practically impossible, but the presence of such cases speaks of the sophistication of scammers who often move from place to place to deceive their clients again and again.

Our company very rarely provides the service of placing a car on commission, since, judging by our experience, the total amount of money received from a quick sale will not differ significantly from the amount that can be received from a commission sale. We should not forget that the advantage of an urgent redemption is the opportunity to immediately receive money for your car, and when placing a car on consignment, the money will come only after the car is sold. However, some of our clients are more interested in putting on a commission rather than urgently replenishing their budget and are willing to wait as long as they need to sell, so we are ready to offer them this option of buying a car. Our clients are satisfied with the work of our specialists and the approach they take in each individual case.